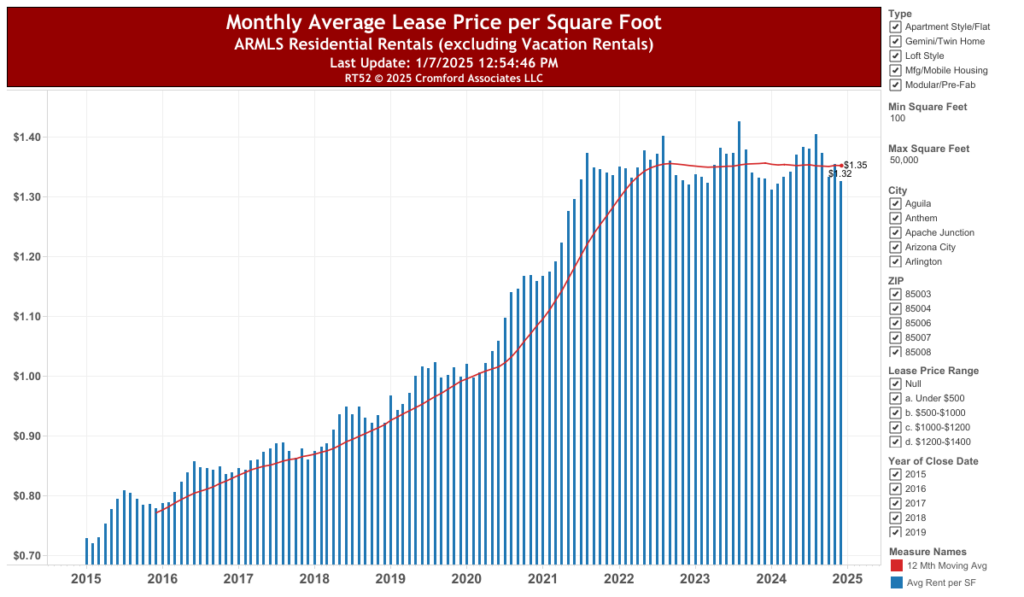

The chart illustrates the monthly average lease price per square foot for ARMLS residential rentals (excluding vacation rentals) from 2015 to early 2025. Here’s a breakdown of key trends and insights into the current market:

Rental Price Trends

- Steady Growth (2015–2021):

From 2015 to 2021, the average lease price per square foot rose steadily, climbing from under $0.80 to around $1.35. This long-term growth was fueled by strong rental demand, population increases, and limited supply in the Phoenix area. - Market Surge (2021–2023):

During this period, rental prices spiked sharply, reaching their peak of $1.35 per square foot. Factors contributing to this surge included:

Phoenix becoming a top destination for out-of-state relocations.

Pandemic-induced housing dynamics, including an influx of renters due to unaffordable home prices.

- Stabilization and Slight Decline (2024–2025):

After years of rapid increases, rental prices plateaued in 2023. By early 2025, prices dipped slightly to $1.32 per square foot. The 12-month moving average indicates that the market is stabilizing, likely due to a combination of increased rental inventory and cooling demand.

Key Factors Influencing the Phoenix Rental Market

Demand-Supply Dynamics:

The pandemic saw unprecedented demand for rentals amid a limited supply of housing, driving prices upward. However, supply is now catching up, which is slowing rental price growth.

Economic Pressures:

Rising mortgage rates and inflation continue to make homeownership less accessible, keeping rental demand robust. However, affordability concerns are starting to weigh on both renters and landlords.

Stabilization of Growth:

With more rental units coming to market and economic conditions stabilizing, growth in lease prices has decelerated. This could signal a return to more sustainable market conditions.

Phoenix Eviction Statistics and Impact

Evictions have risen sharply in Phoenix over the past two years, exacerbating housing challenges for many renters. According to recent data: 2023 Eviction Filings: Phoenix saw over 45,000 eviction filings in 2023, a stark increase compared to pre-pandemic levels of around 30,000 annually.

Causes: Rising rents, inflation, and stagnant wages are key contributors to the spike in evictions. Many renters are struggling to keep up with elevated lease prices, even as the market begins to stabilize.

Wider Impact: High eviction rates can lead to increased rental property turnover and may push some landlords to offer incentives or lower rents to attract tenants in a stabilizing market.

What Lies Ahead?

The Phoenix rental market remains strong, but the stabilization of rental prices suggests that affordability concerns are beginning to impact the market. Eviction trends highlight the ongoing struggles of renters, and these factors could lead to further moderation in price growth as we move through 2025.

Landlords and investors should keep a close eye on the balance between supply and demand, as well as the economic pressures facing tenants, to adjust strategies accordingly.