As we enter the final stretch of the year, the Arizona housing market continues to show signs of stability, though with some interesting contrasts between price tiers and buyer confidence.

Market Overview

According to the latest ARMLS data (as of November 1, 2025), inventory levels continue to climb, while demand has remained relatively steady but modest.

- Active Listings (excluding UCB & CCBS): 25,936 — up 21% from last year and 6.1% higher than last month.

- Active Listings (including UCB & CCBS): 29,052 — up 20% year-over-year and 5.4% month-over-month.

- Pending Listings: 4,248 — up 1.7% from a year ago, but down slightly (0.6%) from last month.

- Closed Sales: 6,135 — up 5.2% compared with November 2024, though down 0.4% from October.

- Average Price per Sq. Ft.: $293.75 — up 1.0% year-over-year and up 2.3% from last month.

- Median Sales Price: $450,000 — unchanged from last year, and down 0.9% from October.

Key Insights

Supply continues to outpace demand, though the growth rate of new listings has begun to slow, signaling a possible plateau in inventory. Mortgage rates have eased slightly, but buyer enthusiasm—particularly among first-time and move-up buyers—remains cautious.

Interestingly, the luxury and super-luxury markets continue to outperform the rest, with affluent buyers showing confidence and capital liquidity. This is contributing to a higher average price per square foot, even as the median price remains flat.

What It Means for Buyers and Sellers

- Buyers: With inventory levels at their highest point in over two years, buyers have more options and slightly more leverage. However, well-priced homes are still moving quickly—especially in desirable neighborhoods or turnkey condition.

- Sellers: While pricing power has softened in the mid-range, homes positioned correctly in the market—priced competitively and presented well—are still seeing strong activity. The key remains strategic pricing and professional marketing.

Looking Ahead

As we close out 2025, the market continues to normalize from the extremes of prior years. Slightly lower mortgage rates could bring a mild boost in demand heading into early 2026, but sustained improvement will depend on broader economic confidence.

For now, it remains a balanced yet cautious market—one that rewards well-prepared buyers and realistic, informed sellers.

the rental market in the Phoenix metro area is showing clear signs of stabilization—with a few important caveats for property owners and investors.

📌 Key Takeaways

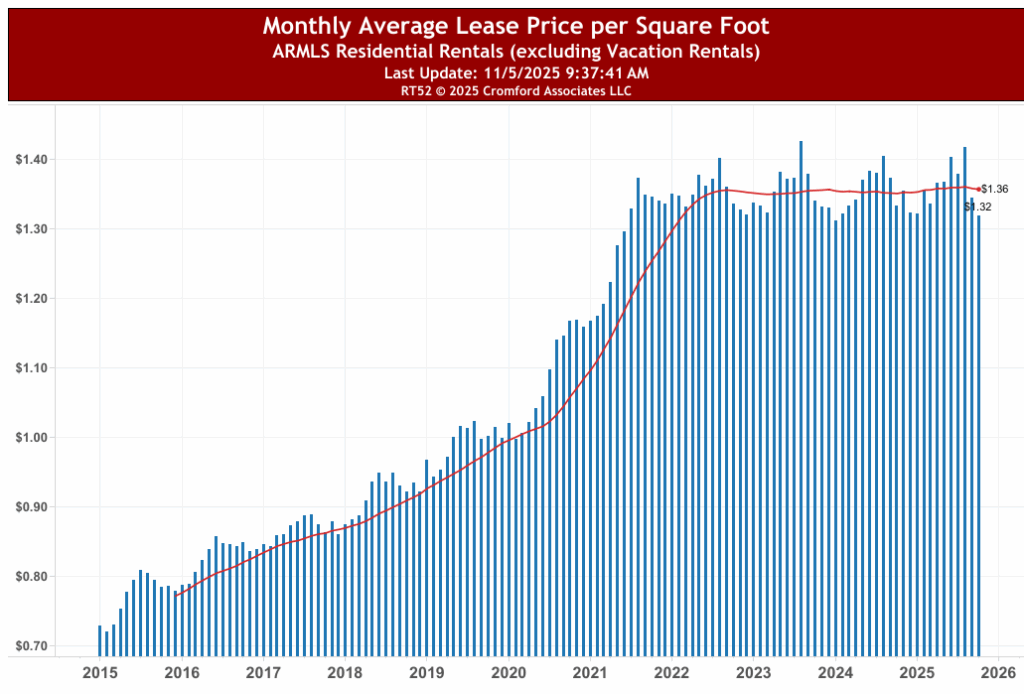

- According to the chart above, the average lease price per square foot in the region has essentially flattened out in recent months after years of sharp growth.

- Data for the Phoenix-metro area show that average rents have dipped modestly year-over-year: for example, one report cites a ~1.94% drop in average apartment rents (from ~$1,524 to ~$1,494) over the last 12 months.

- Meanwhile, the supply side is showing increased activity: one report states that active rental listings rose ~17% year-over-year and the average days-on-market for rentals had ticked up to ~35 days—about 17% longer than a year earlier. Home Ladder

- On the days-on-market front, further evidence shows leasing times are longer than prior peaks. For instance: in Q4 2024, single-family rentals averaged ~32 days on market and multifamily ~31 days in Phoenix. Rental Beast Blog

- The vacancy rate for rental housing in Arizona stands at ~8.8%, per the U.S. Census Bureau for 2024. FRED

✅ What This Means

- For owners and investors, the era of rapid rent escalations appears to be behind us (for now). With more listings entering the rental market and longer time required to place tenants, properties are facing modest pressure.

- For prospective tenants, this translates to somewhat more choice, slightly more negotiation leverage (especially on concessions or lease terms), and a landscape where rent hikes are unlikely to mirror the double-digit pace of recent years.

- For market watchers, the flatting of lease price per square foot suggests we’re at or near a plateau in rent growth. Given that supply is mounting and leasing turnover is slowing, further downward pressure on rents remains a possibility unless demand ramps up.

🔍 Strategic Considerations

- If you’re managing investment rentals: maintaining competitive condition, providing tenant-friendly lease terms, and monitoring turnover costs will be key differentiators in this more tempered market.

- If you’re considering converting a property to rental use: it’s wise to assume a normal leasing cycle, not the ultra-tight “zero-vacancy” environment of earlier years.

- If you’re considering putting your home on the rental market, it’s important to set realistic expectations. Homes are taking a bit longer to lease than they did a year ago, and tenants now have more options to choose from. Offering small incentives — such as a modest rent reduction, flexible lease terms, or minor upgrades that enhance the property’s appeal — can help attract quality tenants faster and reduce vacancy time.

- In this environment, success comes down to presentation, pricing, and patience. The rental market has leveled off, and while rates remain strong historically, standing out matters more than ever.

In short: the chart shows rent per square foot has reached a plateau, while independent data confirm that rental inventory is increasing and days on market are lengthening. The result: a rental market that is stable but cooling, and one where owners should adjust strategies for the new normal.