As we move into February, the housing market continues to show signs of stability, but not without some important shifts worth noting.

We saw an unusually sharp decline in housing supply during December, largely due to sellers pulling listings during the fourth quarter. That trend reversed quickly in January, as many of those cancelled listings returned to the market. As a result, active inventory jumped nearly 10% compared to just one month ago.

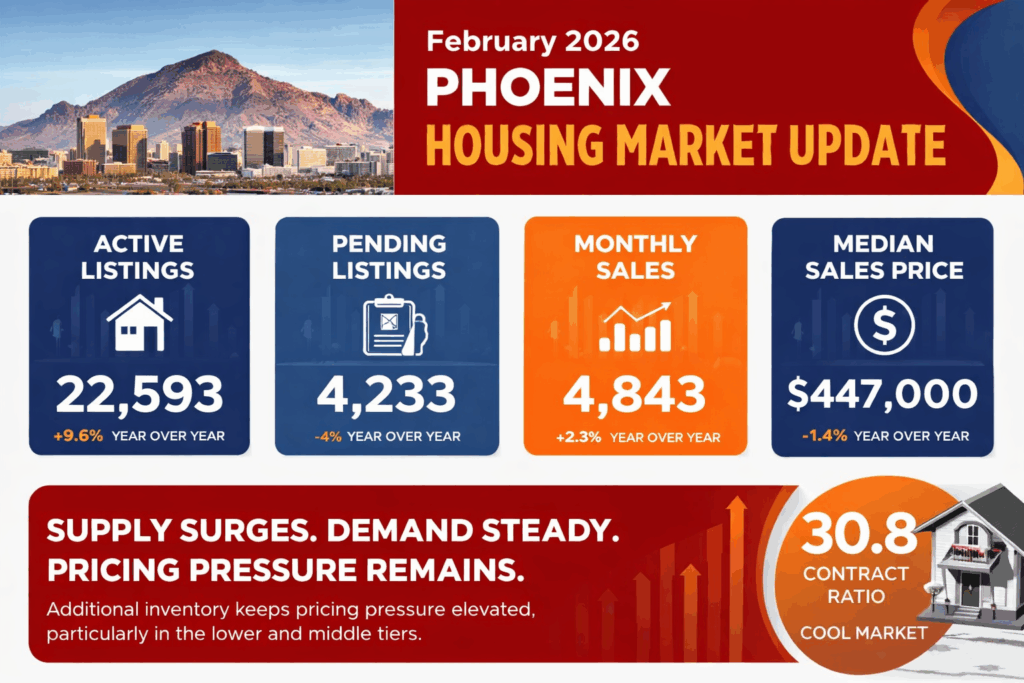

Buyer demand is modestly higher than it was a year ago, though not by as much as many expected—especially considering that interest rates are meaningfully lower. The typical 30-year fixed mortgage rate is currently around 6.2%, compared to just over 7% this time last year. Despite this improvement, pending listings are slightly down year over year. This is partly due to more agents using “Under Contract – Backup” (UCB) status rather than traditional pending status. When looking at all listings under contract, activity is actually up a modest 2.2% compared to February 1, 2025. While that’s an improvement, it still reflects cautious, selective buying rather than strong momentum.

Closings tell a similar story. January recorded 4,843 closed sales, up 2.3% year over year, but down sharply—about 24%—from December’s 6,403 closings. January faced some built-in headwinds, including fewer working days than both January 2025 and December, but even accounting for that, the closing volume was underwhelming given lower borrowing costs.

The contract ratio improved to 30.8 from 25.8 at the start of January, which is a positive directional shift. However, it still indicates a relatively cool market and remains below the 33.0 level we saw this time last year. The primary reason is higher available supply, which continues to give buyers more choices and negotiating power.

Overall, the market is stable and demand is modestly better than a year ago—but not strong enough to offset the increase in inventory. This means sellers are still facing meaningful competition, particularly in the low- and mid-price ranges where supply is heaviest. While the average price per square foot rose 3.7% from December, that figure is being skewed by stronger activity in the upper end of the market. The median sales price, which better reflects the broader market, actually declined 1.8% over the past month.

This widening gap highlights a clear divide: higher-end homes are seeing healthier demand, while entry-level and mid-range properties continue to experience pricing pressure. Strategic pricing and strong presentation remain critical for sellers, especially in areas with elevated inventory.

As always, if you’d like a breakdown specific to your neighborhood or price range, feel free to reach out—I’m happy to help.