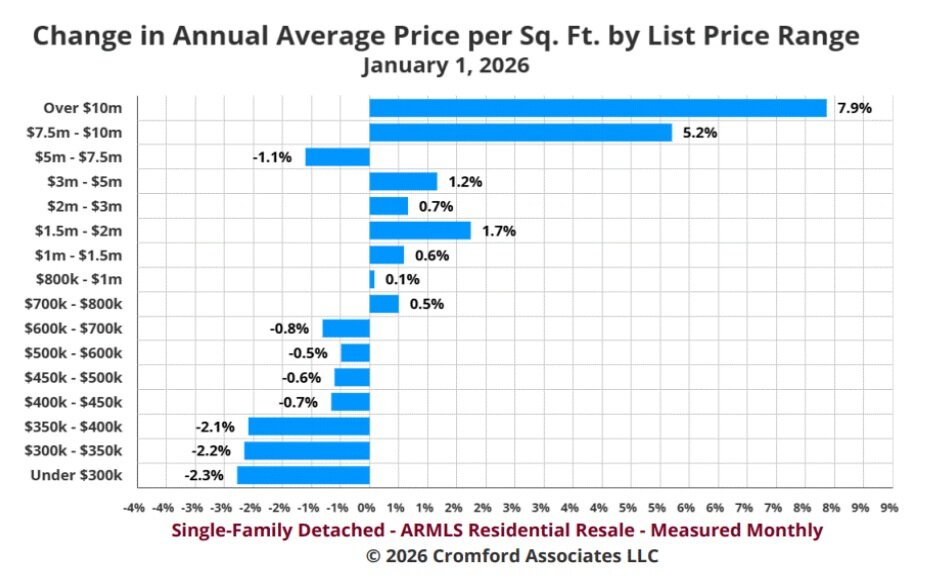

One of the most important—and often overlooked—stories in today’s housing market is how affordability has shifted across different price ranges. The chart above highlights the change in annual average price per square foot by list price range for single-family detached homes, and the takeaway is clearer than many headlines suggest.

Entry-Level Homes Are More Affordable Than a Year Ago

Single-family detached homes priced under $700,000 have experienced modest price declines over the past 12 months. These changes are not dramatic, but they are meaningful—especially when viewed alongside two other critical factors: rising median household incomes and lower mortgage interest rates compared to much of last year.

When these trends are combined, the result is improved real-world affordability for entry-level and mid-range buyers. This stands in contrast to the prevailing narrative that affordability is continually worsening across the board. In reality, many buyers today are in a stronger position than they were a year ago, particularly in the most competitive and accessible segments of the market.

Middle and Upper Price Ranges Show Stability

Homes priced between $700,000 and $1 million have remained relatively stable, with price-per-square-foot changes hovering close to flat. This stability reflects a market that is neither overheating nor retreating, but instead finding equilibrium after the volatility of recent years.

Above $1 million, prices have generally increased—but still at a measured and sustainable pace. These gains are not uniform, and they vary significantly by segment.

The Super-Luxury Market Plays by Different Rules

The one area where pricing behavior diverges sharply is the ultra-luxury segment, particularly homes priced above $7.5 million. In this range, prices have risen well above the rate of inflation, driven by a very small pool of high-net-worth buyers. These buyers are often less sensitive to mortgage rates and are more influenced by broader financial markets, including stocks and cryptocurrency.

By contrast, homes priced between $5 million and $7.5 million actually saw a slight 1.1% decline in average price per square foot. Because sales volume in this range is limited, a small number of transactions can significantly impact annual averages.

Importantly, these super-luxury trends have little to no effect on pricing in the lower and middle segments of the housing market.

What This Means Going Forward

The data shows a market that is becoming more balanced and segmented, rather than universally unaffordable. For buyers focused on entry-level or move-up homes, conditions are improving quietly but meaningfully. For sellers, pricing strategy matters more than ever, particularly outside the ultra-luxury space.

As always, understanding which part of the market you’re in matters far more than broad headlines. Real estate remains highly localized, and opportunity continues to exist for well-informed buyers and sellers alike.